Key features of the report

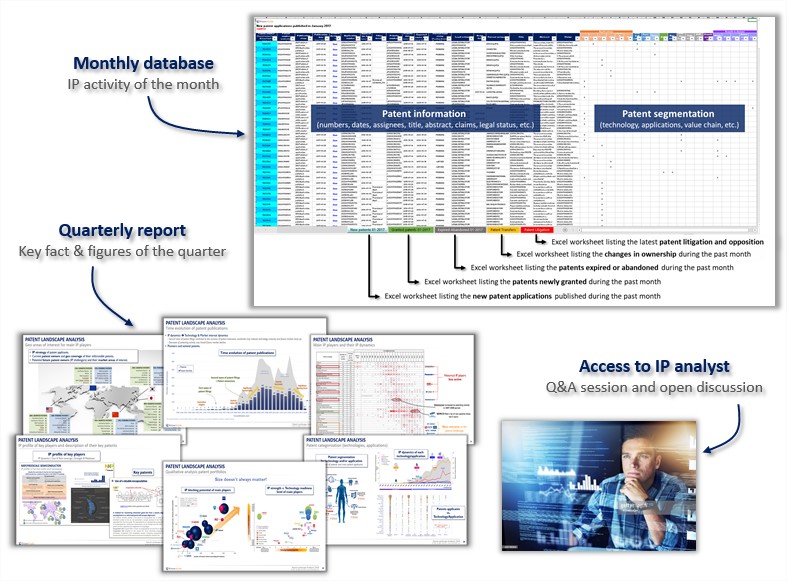

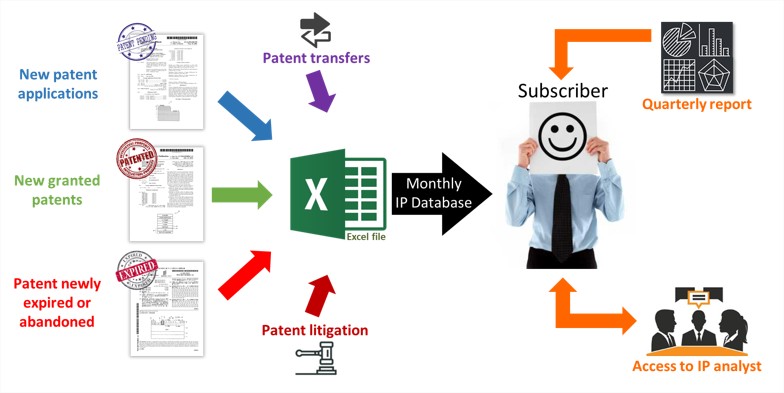

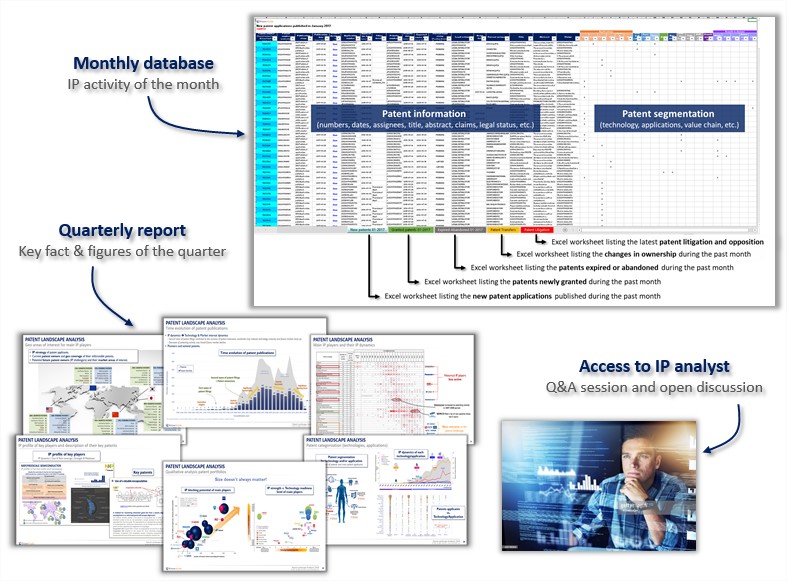

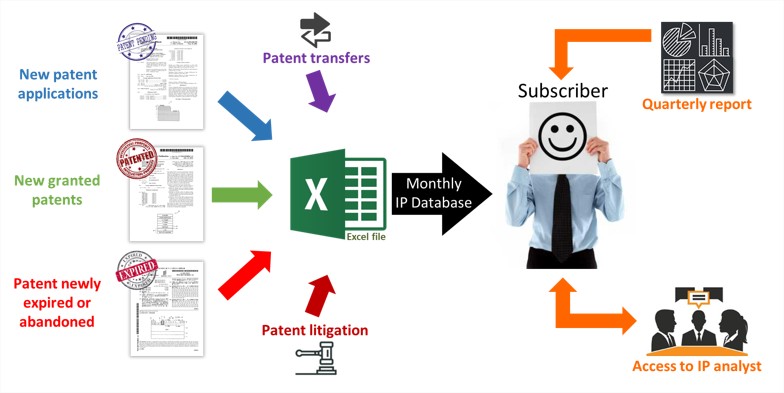

Every month an Excel file including:

- New patents applications.

- Patent newly granted.

- Patents expired or abandoned.

- Transfer of IP rights (re-assignment, licensing)

- Patent litigation and opposition.

- Patents categorized by applications, position in the value chain and technological challenges: Power IC, MMIC, E-mode transistors, Vertical power devices, Wafer & Epiwafer, GaN-on-Silicon, Current collapse & dynamic on-resistance, Thermal issues, etc.

Every quarter a report including:

- Key fact & figures of the quarter.

- IP players and technologies.

Access to IP analyst for 100h a year:

- Q&A session and open discussion with our IP analysts

- Requesting for patent search on company or technology.

Objectives of the report

- Track your competitors, partners or clients

- Identify newcomers to your technology field

- Early detect opportunities and risks for your business strategy

- Be ahead of technology trends

- Identify emerging research areas and cutting-edge technology developments

- Mitigate patent infringement risks

- Take advantage of free technologies

Table of content

-

Introduction

-

Methodology

-

Key fact of the quarter

-

Main IP players

-

Main patent litigations

-

Access to IP analysts

Title: GaN Power & RF – Patent Monitor Service

RF GaN

The RF GaN market is growing fast – driven by military and telecom applications – and there is still a huge potential to develop for RF GaN market players with the advent of 5G infrastructure for instance. In Yole Développement RF GaN 2018 report, analysts forecast a CAGR of 21% leading to a market size of $2,0B by 2024. With RF GaN market ramping up, Knowmade have seen many new players entering the RF GaN patent landscape and several major companies (Fujitsu, Toshiba) strengthening their IP position and challenging well-established IP players (Cree/Wolfspeed, Sumitomo Electric). Furthermore GaN-on-SiC technology has been so far the predominant technology in GaN RF devices market. However in the near future GaN-on-SiC technology will have to compete with GaN-on-Si especially in the telecom market as performance and reliability of this technology keep improving.

In this context, the patent monitoring service allows to identify new entrants in RF GaN competitive landscape and track the IP activity of major players according to the value chain (epiwafer, device, MMIC, etc.), the technology (GaN-on-Si) and technological challenges (thermal management, current collapse). Furthermore, the patent monitoring service provides information about recently expired or abandoned patents which may create new business opportunities and reports recent patent litigations in the field of RF GaN technology.

POWER GaN

Power GaN market may suddenly take off in the next years as many opportunities exist for this technology especially in power supply and EV applications (wireless charging, fast charging). Depending on the actual adoption of GaN power technology by major players of the commercial electronics market, Yole Développement recently forecasts in power GaN 2018 report a CAGR up to 93% (best case), reaching a market size of $423M by 2023. Furthermore, in this market, numerous fabless or fab-lite start-ups (EPC, Navitas, etc.) relying on foundry services such as X-Fab or TSMC compete with major semiconductor companies (Infineon, STMicroelectronics) in order to find the most cost-effective and easy-to-use solution for GaN technology at the system level (E-mode or D-mode devices, SiP or SoC, etc.) and thereby aiming at accelerating the adoption of GaN technology for power applications.

In this context, the patent monitoring service gives periodic insights on the IP activity of start-up & big companies, according to the level of integration (package or chip) and functionalization of power IC, the technology (E-mode, vertical devices) and technological challenges (thermal issues, dynamic on-resistance). Furthermore, the patent monitoring service allows to early detect newcomers in the field of power GaN, and details the IP collaborations and transfer of rights between IP players.

BENEFITS OF THE PATENT MONITORING SERVICE

Keep a watch on your competitors’ IP activities and their future intentions.

With the help of the patent monitoring service, you will be aware of your competitors’ current patenting activities, their IP dynamics, patent transfers including acquisitions and licenses, patent litigation, technology development and R&D strategies. You will also be able to early detect new entrants in your business area.

Keep track of the latest technology developments and be ahead of technology trends.

By keeping note of any recent patent filings, you can track the newest innovations in the field. You will get details on claimed inventions and you can follow technology developments. New technical solutions could inspire and improve your R&D activity.

Prevent registration of IP rights that may be harmful to your business.

You will obtain information on patent applications filed even before exclusive rights have been granted and you can react in time to prevent registration of IP rights that may be harmful to your business.

React in time to infringements and mitigate legal risks.

Monitoring newly-issued patents allows you to regularly assess your freedom-to-operate, ensuring your products or processes are not covered patents and thus they can be manufactured, sold or used safely without infringing valid IP rights owned by others.

Take advantage of free technologies and decrease R&D project risks.

By tracking both expired patents and abandoned patents, you will be able to identify inventions entering the public domain that you can use safely for your development.

Understand the current IP trends and IP strategy of competitors

On a quarterly basis, the report will provide the IP trends over the three last months, with a close look to key IP players and key patented technologies. Main patent applicants and their inventions, blocking patents, promising patents and key patents newly expired or abandoned will be highlighted..

Access to the IP analyst

Take advantage of direct interaction with our analysts by phone call and/or email and get specific input for specific patented technologies and company IP portfolios through Q&A session and open discussion (100h a year).